Unpacking The Larry Fink Salary: What Drives Compensation For A Financial Titan?

Many people are curious about how the leaders of big companies get paid. It's a topic that, you know, often sparks a lot of discussion. When we talk about figures like Larry Fink, who is a very significant person in the financial world, questions about his salary come up quite a bit. It’s pretty natural to wonder how someone at the helm of such a massive firm, BlackRock, receives their earnings.

So, looking at the Larry Fink salary gives us a peek into the world of top executive pay. It’s not just a simple number; it’s a rather complex mix of different elements. You might find this sort of detail fascinating, especially if you follow the financial markets or just like to understand how the biggest players are compensated for their work.

This discussion aims to shed some light on what goes into the Larry Fink salary. We will look at the different parts of his pay and, you know, why it tends to be such a large figure. Understanding this helps us grasp the bigger picture of leadership pay in today's global economy, just like exploring other prominent figures discussed in information like My text.

Table of Contents

- Larry Fink: A Brief Look

- Understanding Executive Compensation at BlackRock

- The BlackRock Influence on Global Finance

- Why Such High Salaries?

- Public Perception and Debate

- Looking at Recent Compensation Trends

- Frequently Asked Questions About Larry Fink's Compensation

Larry Fink: A Brief Look

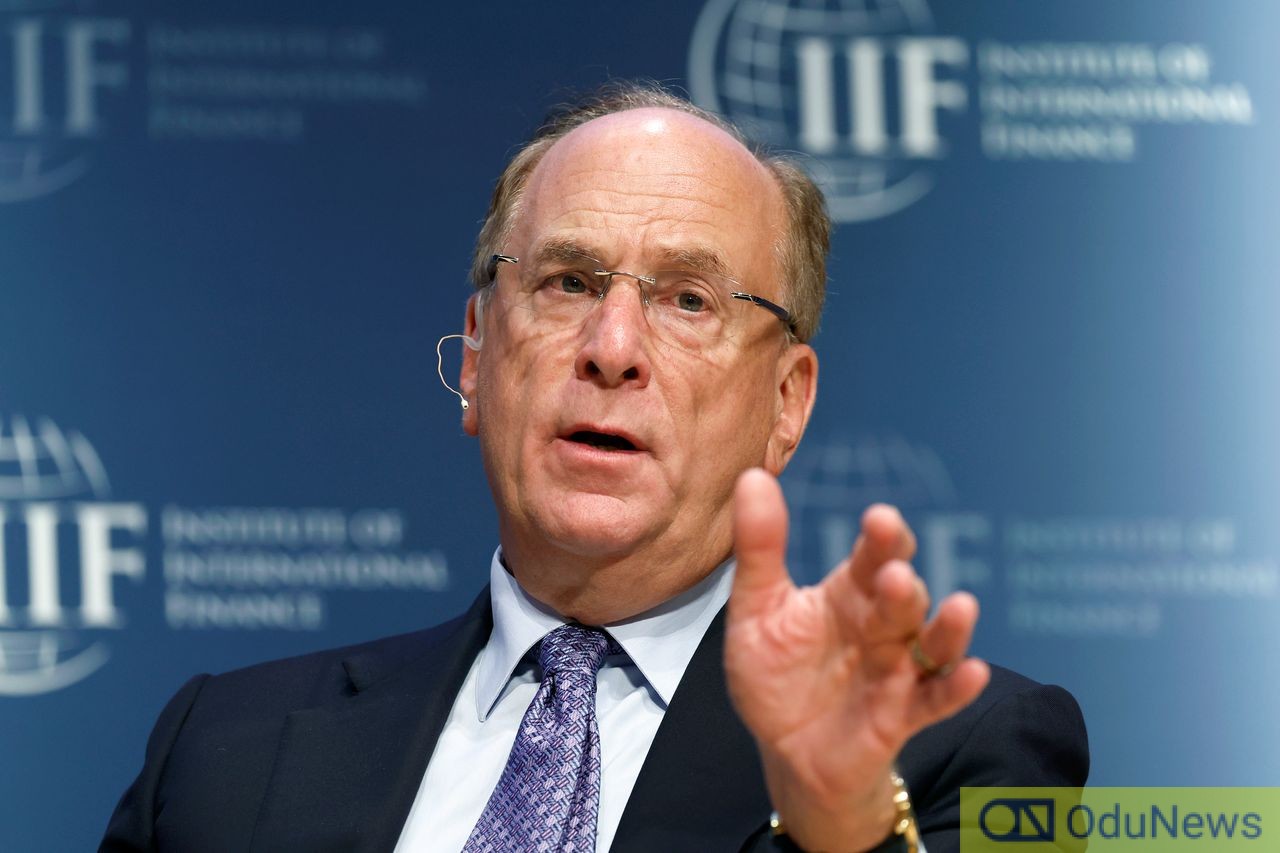

Larry Fink is, quite simply, a very well-known figure in the world of finance. He co-founded BlackRock, which has grown to be one of the biggest investment management firms on the planet. His leadership has, you know, really shaped how the company operates and its standing in the financial community.

His story is one of building something massive from the ground up. He started BlackRock with a small group of partners in 1988. It's pretty amazing to think about how much it has grown since then, becoming a true powerhouse in managing money for others.

Personal Details

| Detail | Information |

|---|---|

| Full Name | Laurence Douglas Fink |

| Born | November 2, 1952 |

| Place of Birth | Van Nuys, California, U.S. |

| Education | UCLA (BA in Political Science), UCLA Anderson Graduate School of Management (MBA) |

| Current Role | Chairman and CEO of BlackRock |

| Co-founder | BlackRock (1988) |

His Role at BlackRock

As the Chairman and CEO, Larry Fink's role at BlackRock is, you know, quite central. He guides the overall strategy of the company. This means making big decisions about where BlackRock invests and how it serves its clients all over the world. He's, like, the chief architect of the firm's direction.

He also plays a very public role, often speaking about global economic trends and, you know, the future of investing. His annual letters to CEOs and clients are widely read and can actually influence how other companies think about their own operations and responsibilities. It's a pretty big deal.

His leadership has helped BlackRock manage trillions of dollars in assets. This makes him, in a way, one of the most influential people in global finance. His decisions and vision have a real impact on, you know, markets and economies across the globe.

Understanding Executive Compensation at BlackRock

When we look at the Larry Fink salary, it’s not just a single payment. It’s typically made up of several parts, each designed to, you know, motivate and reward long-term performance. This structure is pretty common for leaders of very large companies, especially in the financial sector.

Companies like BlackRock have compensation committees, which are groups of people on the board who decide on executive pay. They look at many things to set these figures. It’s a rather detailed process, trying to balance what's fair for the executive with what's good for the company and its shareholders.

What Makes Up the Pay?

The Larry Fink salary, like many executive pay packages, usually has a few main components. There's a base salary, which is a fixed amount paid regularly. This is, you know, the most straightforward part of the compensation.

Then, there's a cash bonus, which is often tied to the company's yearly performance. If BlackRock does well, so, too, does the bonus amount. This part is, in a way, a reward for short-term achievements and meeting specific goals.

A very significant portion of the Larry Fink salary comes from equity awards, like stock options or restricted stock units. These are basically shares in the company that vest over time. This means he gets to own them fully after a certain period, or if certain performance targets are met. This part is really designed to align his interests with those of the company's long-term success and, you know, its shareholders.

Performance Metrics

For someone like Larry Fink, his compensation is very much linked to how BlackRock performs. The company sets specific goals, or metrics, that he needs to meet. These might include things like the total amount of money BlackRock manages, which is called assets under management (AUM).

Other important metrics could be the company's profits, its stock price performance, and even client satisfaction. These measures are chosen because they, you know, reflect the overall health and growth of BlackRock. It’s a way to ensure that pay is earned through real results.

Sometimes, there are also non-financial goals, like progress on sustainability initiatives or diversity within the company. These are becoming, you know, more common in executive pay structures. It’s all about linking pay to the things that truly matter for the company’s future.

Market Factors

The financial industry is very competitive, so, you know, companies need to offer attractive pay to get and keep top talent. The Larry Fink salary is also influenced by what other leaders in similar roles at other large financial firms are earning. It’s a bit of a comparison game, actually.

The size and global reach of BlackRock also play a big part. Managing trillions of dollars and operating across many countries is a huge job. The market, you know, tends to reward leaders who can handle such vast responsibilities with significant compensation. It's pretty straightforward, in a way.

Economic conditions and market trends can also affect executive pay. In good times, compensation might be higher, while in tougher periods, it could be less. This flexibility is, you know, built into the structure to reflect the realities of the business environment. It's a rather dynamic system.

The BlackRock Influence on Global Finance

BlackRock is not just a big company; it's a very influential one in the global financial system. Its sheer size means that its decisions can, you know, send ripples across markets. Larry Fink, as its leader, is at the center of this influence.

The company manages money for a huge variety of clients, from pension funds to individual investors. This means it has a pretty significant say in how capital is allocated around the world. It’s a kind of responsibility that comes with, you know, a lot of weight.

Scale of Operations

BlackRock manages an absolutely enormous amount of money. We are talking trillions of dollars. This makes it, you know, the largest asset manager in the world. The scale of its operations is almost hard to grasp.

The company invests in all sorts of things: stocks, bonds, real estate, and more. It uses various investment strategies, from passive index funds to active management. This wide range of activities means it touches nearly every part of the financial market, so, you know, its reach is pretty vast.

This immense scale means that even small shifts in BlackRock's strategy can have big effects. For instance, if BlackRock decides to, you know, invest more in a certain type of asset, other investors might follow. It’s a truly powerful force in the financial system.

Impact on Markets

BlackRock's size gives it a lot of influence over market trends. When Larry Fink speaks about, for example, the importance of environmental, social, and governance (ESG) factors, other companies and investors tend to listen. This is because BlackRock, you know, holds so many shares in so many companies.

The firm's shareholder engagement efforts are also quite impactful. BlackRock talks to companies it invests in about their governance, their business practices, and their long-term strategies. This can, you know, encourage companies to make changes that align with broader market expectations or societal values.

Its technology platform, Aladdin, is also widely used by other financial institutions. This means BlackRock's tools and insights are, in a way, helping to shape risk management and investment decisions across the industry. It’s a pretty deep level of influence, actually.

Larry Fink's Vision

Larry Fink is known for his annual letters, which are, you know, widely anticipated by the business community. In these letters, he shares his views on global economic issues, investment trends, and the responsibilities of corporations. He often talks about long-term value creation.

He has been a very strong voice for sustainable investing, urging companies to consider their impact on society and the environment. This focus on ESG has, you know, actually encouraged many other firms to adopt similar practices. It's a significant part of his legacy.

His vision extends beyond just financial returns; he often speaks about the role of capitalism in society. This broader perspective, you know, makes him a thought leader, not just a money manager. It’s pretty unique, in some respects.

Why Such High Salaries?

The question of why top executives like Larry Fink receive such high salaries is, you know, often debated. There are several arguments put forward to explain these significant figures. It’s a topic that brings up many different viewpoints, actually.

One common reason cited is the sheer scale of responsibility that comes with leading a global firm. Managing trillions of dollars and thousands of employees across the world is, you know, a truly demanding job. It’s not something just anyone can do.

Attracting Top Talent

Companies argue that they need to offer very competitive compensation to attract and keep the best leaders. If the Larry Fink salary were much lower than what other top CEOs in similar roles earn, it might be harder to, you know, find someone with his skills and experience. It's a matter of market dynamics, apparently.

The pool of individuals capable of leading a firm as large and complex as BlackRock is, you know, pretty small. These are people with unique skills, extensive experience, and a proven track record of success. So, the pay reflects that scarcity of talent, in a way.

High salaries are also seen as a way to motivate these leaders to perform at their very best. The idea is that, you know, linking pay to performance encourages them to make decisions that benefit the company and its shareholders over the long haul. It’s a common business practice.

Responsibility and Risk

Leading a company like BlackRock comes with enormous responsibility. Larry Fink is accountable for the financial well-being of millions of clients and the performance of trillions of dollars in assets. The decisions he makes can, you know, have far-reaching consequences for many people.

There's also a significant amount of risk involved. The financial markets can be very volatile, and leaders must navigate through economic downturns, regulatory changes, and unexpected global events. This constant pressure and the potential for, you know, adverse outcomes are factored into the compensation. It’s a pretty high-stakes role.

The legal and reputational risks are also considerable. Any misstep by a firm of BlackRock's size can lead to, you know, huge financial penalties and damage to its standing. The Larry Fink salary, in some respects, compensates for bearing these heavy burdens.

Shareholder Value

A key argument for high executive pay is that it is tied to creating value for shareholders. If the company's stock price goes up, and its profits grow, then the shareholders benefit. The Larry Fink salary, particularly the equity portion, is designed to, you know, reward him for delivering these positive results.

The idea is that a highly motivated and effective CEO can drive the company to greater success, which in turn, makes the shareholders richer. So, the compensation is seen as an investment in leadership that, you know, pays off for everyone who owns a piece of the company. It’s a pretty direct link, in theory.

Companies often point to long-term stock performance and overall company growth as justification for executive pay. If BlackRock continues to grow and perform well, then, you know, the argument is that Larry Fink's compensation is well-deserved. It’s all about the returns for the investors.

Public Perception and Debate

Discussions around the Larry Fink salary, and executive pay in general, often spark strong reactions. Many people find the figures to be very high, especially when compared to average wages. This leads to, you know, a lot of public conversation and sometimes criticism.

There's a constant debate about what constitutes fair compensation for top leaders. Some argue that the pay is excessive, while others maintain it is necessary to attract the best talent for complex roles. It’s a topic with, you know, many different viewpoints.

Discussions Around Executive Pay

The public, and even some investors, frequently question the fairness of executive compensation. They might wonder if the pay is truly linked to

Larry Fink Salary 2024 Nfl - Joane Ekaterina

Larry Fink Salary 2024 - Mei Matilde

Larry Fink Salary 2024 - Mei Matilde