Your Net Worth: A Clear Picture Of Your Financial Standing Today

Have you ever stopped to think about your financial position, really think about it? It's a bit like taking a snapshot of your money situation at a certain moment. This snapshot, this one key figure, is what we call your net worth. It’s a very simple idea, yet it tells you so much about where you stand financially, and frankly, it can be quite eye-opening.

Figuring out your net worth isn't some secret, complicated task for financial wizards only. It’s actually quite straightforward, and it's something everyone has, whether they know the number or not. Knowing this figure gives you a clear point to start from, sort of a baseline, as you work on your money goals. It helps you see what you own and what you owe, which is pretty important, you know?

This idea of net worth is a tool, a way to measure your financial health. It’s not about how much money you make each month, but rather what you've built up over time. It can be a very powerful number for tracking progress, and it helps you make smarter choices for your future, too. So, let’s get into what it really means and how you can figure out your own.

Table of Contents

- What is Net Worth?

- Why Does Net Worth Matter?

- How to Calculate Your Net Worth

- Understanding Your Net Worth Figure

- Boosting Your Net Worth: Practical Steps

- Common Questions About Net Worth

- Your Net Worth Journey Begins

What is Net Worth?

Net worth, at its core, is a very simple calculation. It’s what you have, minus what you owe. Think of it like this: it's the total value of everything you own, with all your debts taken away. As the information suggests, "Net worth is the value of an individual's or company's assets minus their liabilities." It's a pretty clear way to see your financial position at any given time, you know?

This number gives you a quick look at your financial health. It's a data point you can use to track how well you're doing over time. So, it's not just a random figure; it's a very meaningful one for your money picture. "Net worth—or the total of your assets minus liabilities—is a snapshot of your financial health at a specific point in time."

Basically, everyone has a net worth number. It might be positive, it might be negative, but it's always there. Knowing this number is the first step toward understanding and improving your financial situation. It’s a bit like getting a report card for your money, actually.

Assets: What You Own

When we talk about assets, we're talking about everything you own that has some kind of value. This can include a lot of different things, and it’s pretty important to list them all out. For example, your savings account balance is an asset, and so is your checking account. Any money you have in investment accounts, like stocks or mutual funds, counts here too.

Your home, if you own it, is typically a big asset. Your car, even if it's losing value, still has some worth. Collectibles, jewelry, and even things like valuable art or furniture can be assets. Basically, if you could sell it for money, it’s an asset. So, you might have more assets than you first think, actually.

It’s about putting a dollar figure on these things, even if it’s just an estimate. Knowing what you own is the first half of the net worth equation. It's really about taking stock of all your possessions that hold monetary value, which is quite a lot for most people.

Liabilities: What You Owe

Now, on the flip side, we have liabilities. These are all the things you owe money on. Just like assets, this list can be quite varied, and it’s good to be thorough. For instance, if you have a mortgage on your home, that’s a liability. Student loans are a very common one for many people, too.

Credit card balances, especially if they carry over month to month, are definitely liabilities. Car loans, personal loans, and even things like medical bills that you haven't paid yet count. Any money you're obligated to pay back to someone else is a liability, you know?

It’s about adding up all those debts. This is the second half of the net worth calculation. Being honest about what you owe is just as important as knowing what you own. It paints a full picture of your financial commitments, which is pretty essential.

Why Does Net Worth Matter?

Understanding your net worth is more than just a number; it's a powerful tool for your financial journey. It provides a very clear snapshot of your financial position, as mentioned in the provided text. This snapshot can help you see where you are right now, and where you might be headed. It's a bit like a financial GPS, you know?

For one thing, it helps you track your progress over time. If you calculate your net worth every year, you can see if you're moving in the right direction. Are your assets growing? Are your liabilities shrinking? This kind of tracking can be very motivating, and it shows you the results of your financial habits. It’s pretty satisfying to see that number grow, actually.

Also, knowing your net worth helps you make smarter decisions. If you're thinking about a big purchase, like a new home or a new car, your net worth can tell you if you're financially ready. It helps you avoid taking on too much debt, which is a common pitfall. It’s a really good way to keep yourself accountable, too it's almost.

The median net worth of all Americans in 2022 was $192,900, while the average net worth was $1.06 million. These figures show a wide range, but they also give you a general idea of where people stand. It’s not about comparing yourself to others, but understanding the bigger picture of wealth distribution. This information can be quite interesting, you know?

How to Calculate Your Net Worth

Calculating your net worth is pretty simple, as the text points out: "Net worth is what you own minus what you owe." It's a straightforward math problem. You gather up all your assets, add them together, then gather up all your liabilities, and add those up too. Then, you subtract the total liabilities from the total assets. That’s your net worth number, basically.

Here’s a step-by-step way to do it:

- List All Your Assets:

- Cash in checking and savings accounts

- Investment accounts (stocks, bonds, mutual funds, retirement accounts like 401k or IRA)

- Value of your home (what it could sell for, not what you paid)

- Value of vehicles (cars, motorcycles, boats)

- Valuables (jewelry, art, collectibles)

- Other significant possessions

Add up all these values to get your total assets. This might take a little bit of time to gather all the figures, but it’s worth it.

- List All Your Liabilities:

- Mortgage balance

- Credit card debt

- Student loan debt

- Car loan balances

- Personal loans

- Any other outstanding debts

Add up all these amounts to get your total liabilities. This part can be a bit sobering for some people, but it’s a necessary step.

- Calculate:

Subtract your total liabilities from your total assets.

Total Assets - Total Liabilities = Net Worth

And there you have it! Your net worth number. It's really that simple to get a clear picture.

You can use a "net worth calculator" to help with this, as some tools are available to make it easier. "Use our free calculator to learn yours," the text suggests. These tools can streamline the process, especially if you have many different accounts or debts. It just makes things a little bit smoother, you know?

Understanding Your Net Worth Figure

Once you have your net worth number, what does it mean? A positive net worth means you own more than you owe, which is generally a good sign of financial health. A negative net worth means your liabilities are greater than your assets. This isn't necessarily a bad thing, especially for younger people just starting out with student loans or a first mortgage, but it does show you have work to do, actually.

Your net worth is a fluid number; it changes all the time. The value of your assets can go up or down, and your debts will change as you pay them off or take on new ones. That's why it's good to check it regularly, maybe once a year, to see how things are progressing. It’s not a fixed point, but rather a moving target, in a way.

It’s also important to remember that net worth is just one piece of your financial puzzle. It doesn't tell the whole story of your income, your spending habits, or your future earning potential. But it is a very important piece, and it gives you a solid foundation for financial planning. It helps you see the bigger picture, you know?

Tracking your net worth online can be helpful. Some services allow you to "publicize your net worth anonymously, compare it to others & see where you stack up," as the text mentions. This can be motivating for some, but remember that your personal financial journey is unique. It’s about your goals, not someone else's. So, keep that in mind, pretty much.

Boosting Your Net Worth: Practical Steps

If you want to see your net worth grow, there are two main ways to make that happen: increase your assets or decrease your liabilities. Often, doing both at the same time is the most effective approach. It’s a bit like pushing from both ends to meet in the middle, actually.

Here are some practical things you can do:

- Save More Money: Putting more money into your savings accounts, especially high-yield ones, directly increases your cash assets. Even small, regular contributions add up over time. It’s a very simple step that has a big impact, you know?

- Invest Wisely: Investing in stocks, bonds, or real estate can help your assets grow. Over the long term, investments often provide a better return than just keeping cash in a regular savings account. Learning about investing is a pretty good idea for this. You can learn more about personal finance on our site.

- Pay Down Debt: Reducing what you owe, especially high-interest debt like credit card balances, is a very effective way to improve your net worth. Every dollar you pay off reduces your liabilities. It’s like clearing out clutter, but for your money, basically.

- Increase Your Income: Earning more money gives you more to save and invest, and more to put towards debt repayment. This could mean asking for a raise, starting a side hustle, or developing new skills. It’s a direct path to adding to your assets, usually.

- Control Spending: Spending less means you have more money left over to save, invest, or pay down debt. Creating a budget and sticking to it can make a big difference here. It's about making conscious choices with your money, rather than letting it just disappear.

- Maintain Asset Value: For things like your home or car, keeping them in good condition can help them hold their value better. Regular maintenance can prevent bigger, more costly issues down the road. This helps preserve your assets, which is quite important.

It’s about making consistent, smart choices over time. There's no magic trick, just steady effort. Every little bit helps, and it all adds up to a stronger financial picture. It’s a marathon, not a sprint, as they say, you know?

Common Questions About Net Worth

People often have similar questions when they first start looking into their net worth. Here are a few common ones:

Why is net worth important for me?

Your net worth is important because it gives you a clear and simple measure of your overall financial health. It’s a way to see if you're building wealth or if debt is holding you back. It helps you set financial goals, like saving for retirement or a down payment on a house, and then track your progress towards those goals. It's a very practical tool for managing your money, really.

How often should I calculate my net worth?

Calculating your net worth once a year is a pretty good habit for most people. This allows you to see trends and evaluate the impact of your financial decisions over a meaningful period. Some people like to do it more often, like quarterly, especially if they are actively working on big financial changes. The key is consistency, so pick a frequency that works for you and stick to it, you know?

Is my house part of my net worth, even if I have a mortgage?

Yes, your house is absolutely part of your net worth! The value of your home is an asset. However, the outstanding balance on your mortgage is a liability. So, when you calculate your net worth, you include the market value of your home as an asset, and then you subtract the amount you still owe on your mortgage as a liability. The difference is the equity you have in your home, which contributes to your net worth. It’s about the net effect, basically.

Your Net Worth Journey Begins

Understanding your net worth is a fundamental step toward taking control of your financial future. It's not just a number; it’s a reflection of your past financial decisions and a guide for your future ones. By regularly calculating it, you gain clarity, track progress, and make more informed choices about your money. It’s a pretty empowering thing to do, you know?

So, take the time to figure out your own net worth today. Gather your asset values, list your liabilities, and do the simple math. It’s a very clear way to see where you stand. From there, you can start making plans to improve that number, little by little, over time. This foundational knowledge is quite helpful for anyone looking to build a more secure financial life. For more detailed insights, you might find information at a trusted financial resource like Investopedia, for example. You can also explore other financial topics on our site.

Your financial journey is unique, and your net worth is a personal score card that helps you play your best game. It’s about setting yourself up for success, and that starts with knowing your numbers. So, go ahead and discover your net worth; it’s a powerful step toward a brighter financial tomorrow, actually.

How to calculate your net worth – Personal Finance Club

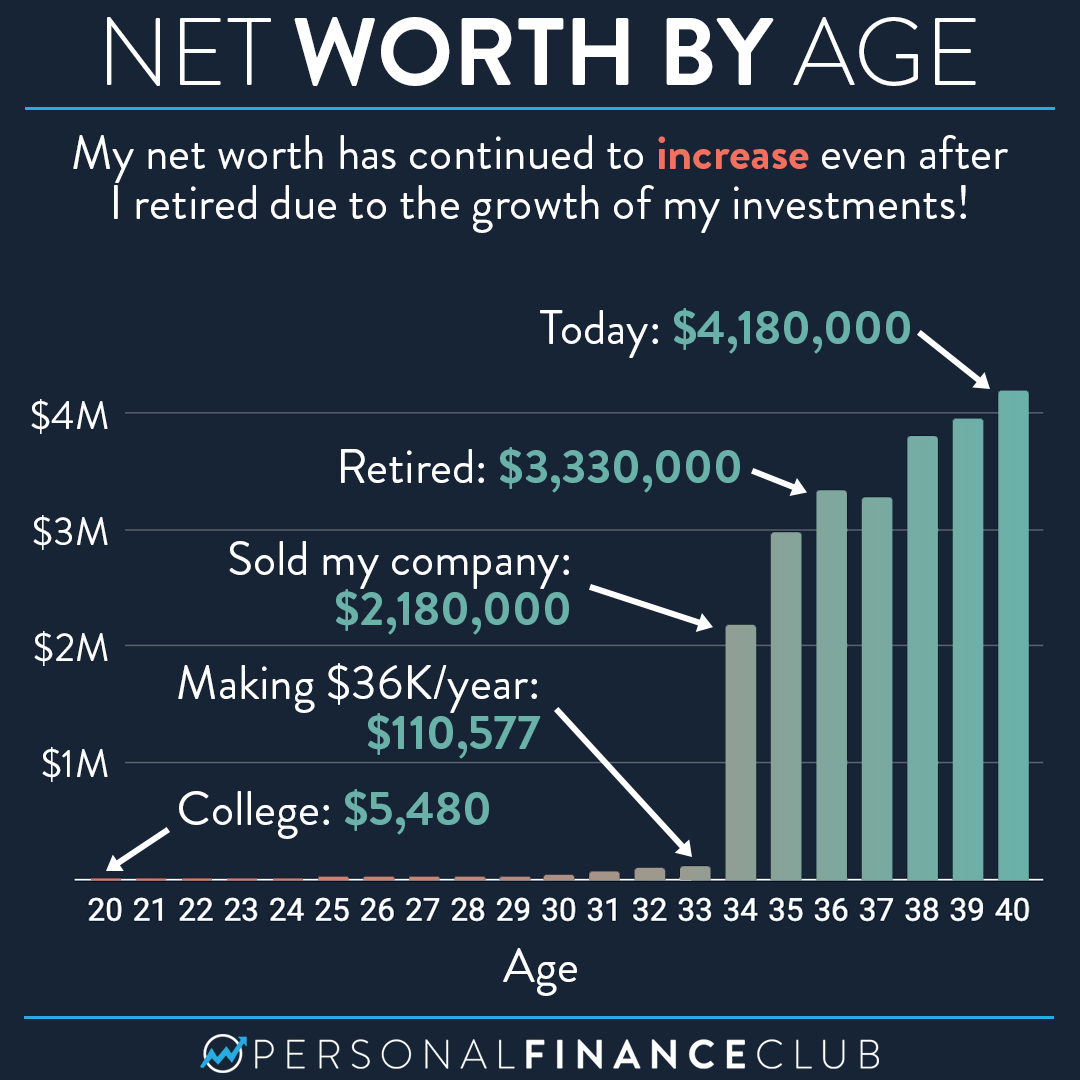

Here’s how my net worth has changed in the last 20 years – Personal

Networth Tracker